The Price of Inequality: How Today’s Divided Society Endangers Our Future, by Joseph E. Stiglitz (W. W. Norton, 2012)

My economics training as a sociologist — with a background in American Culture studies — has been spotty and roundabout. I got a healthy dose of Marxist economics in college, and then some feminist economics, a little human capital theory and some dated econometrics in grad school and since.

All that made reading made it interesting, and also frustrating, to read The Price of Inequality, by Joseph Stiglitz – a winner of the Nobel Prize for economics and an “insanely great economist,” according to Paul Krugman.

On the plus side, I am glad to see someone within mainstream economic theory freely discussing all the ways that common assumptions simply do not predominate in the modern economic scene. Especially helpful in this category is his discussion of how “rents” accumulate vast resources at the upper end of the income distribution, with perverse effects on economic development and politics alike. At the very top — in the finance sector especially, but also in energy and big manufacturing — there is nothing like free-market competition. And the beneficiaries of those distortions are the most powerful players in the economy and political system.

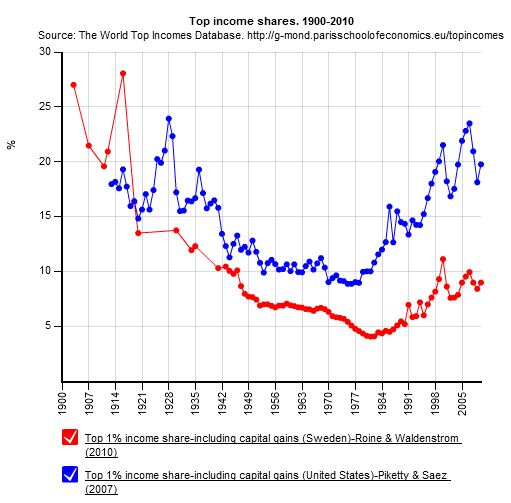

It is refreshing to see this concentration of wealth described as waste and distortion, as their vast profits provide little gain to anyone else. In fact, dumping vast wealth on the 1% creates a drag on the macroeconomy while fueling the historic run-up in economic inequality. This is all very timely and takes you right through the financial crisis up to early 2012.

So if you want to understand from an economic perspective how “the market” in America isn’t the way it’s supposed to be, this book may be for you.

The other good thing about the book for many readers will be its cogent and comprehensive economic rationale for the liberal reforms that many of you probably supported already. Stiglitz makes the case that a suite of reforms – an agenda Rachel Maddow, Elizabeth Warren and Robert Reich probably agree on – would, by (directly or indirectly) increasing taxes (or reducing subsidies) on the wealthy and redistributing wealth downward, reduce the federal debt, increase economic growth, and reduce economic inequality all at the same time.

Round numbers: if the richest 1% earn about 20% of all income, then taxing them another 10% would generate government revenue equivalent to 2% of GDP. (And it wouldn’t hurt anything, since they just hoard or waste their extra cash anyway rather than “creating jobs” with it, and they’re so greedy they wouldn’t be discouraged by the disincentive effect of higher taxes.) That’s an amount of money that could actually be useful for poor people.

The frustration I feel reading the book is more amorphous. I think there have to be better ways of describing this whole system than using the language of mainstream economics, which ends up painting a picture of an entire system that does not work according to the rules as imagined. Concepts like power, social class, social networks, elites and reification do not figure heavily in this story. In fact, Stiglitz’s apparent ignorance of sociology is sometimes funny as in this passage:

Social sciences like economics differ from the hard sciences in that beliefs affect reality: beliefs about how atoms behave don’t affect how Adams actually behave, but beliefs about how the economic system functions affect how it actually functions. George Soros, the great financier, has referred to this phenomenon has “reflexivity,” and his understanding of it may have contributed to his success.

I guess after what people like me have made of econometrics it’s only fair that economists would attribute the idea of reflexivity to Soros. (The discussion of reflexivity in Anthony Giddens’s book The Consequences of Modernity is very approachable.)

Anyway, the book is easy to read and informative, and has lots of footnotes and references.

got a healthy dose of Marxist economics in college

That doesn’t engender trust in sociology.

then some feminist economics

That engenders even less.

LikeLike

ronjohn-I think you misunderstand. Marx was an economist. He was also a sociologist. Since sociology happens to to be focused mostly on sociology, there’s not much likelihood that you’ll spend much time focusing on strictly economic theorists like Keynes, but cross-discipline scholars like Marx are more relevant. And Marx’s ideas were considered fundamental to economics, so [commment edited to remove personal attack -pnc]

LikeLike